28 de enero 2021

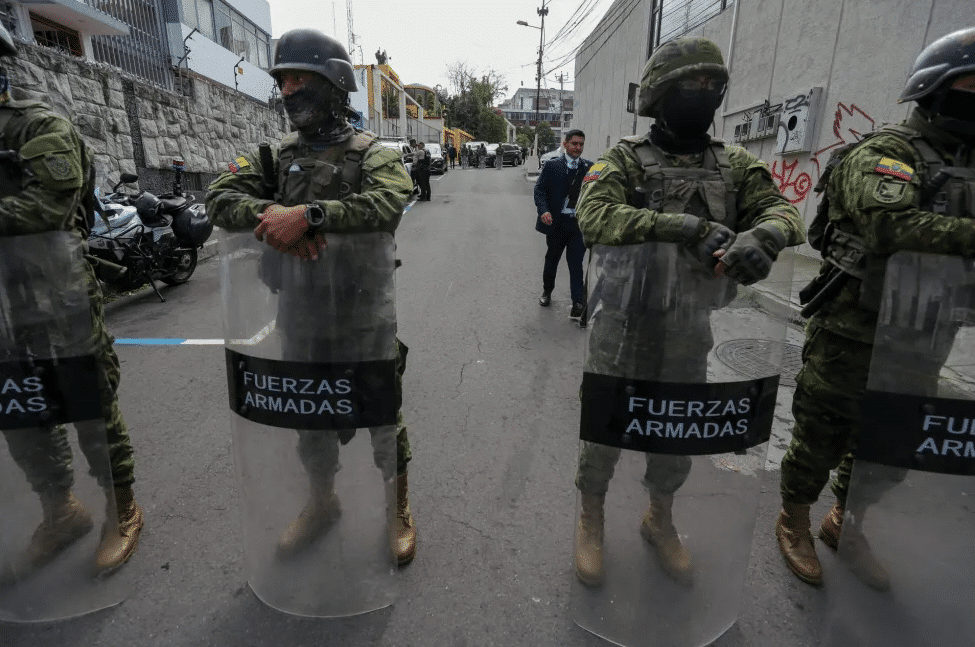

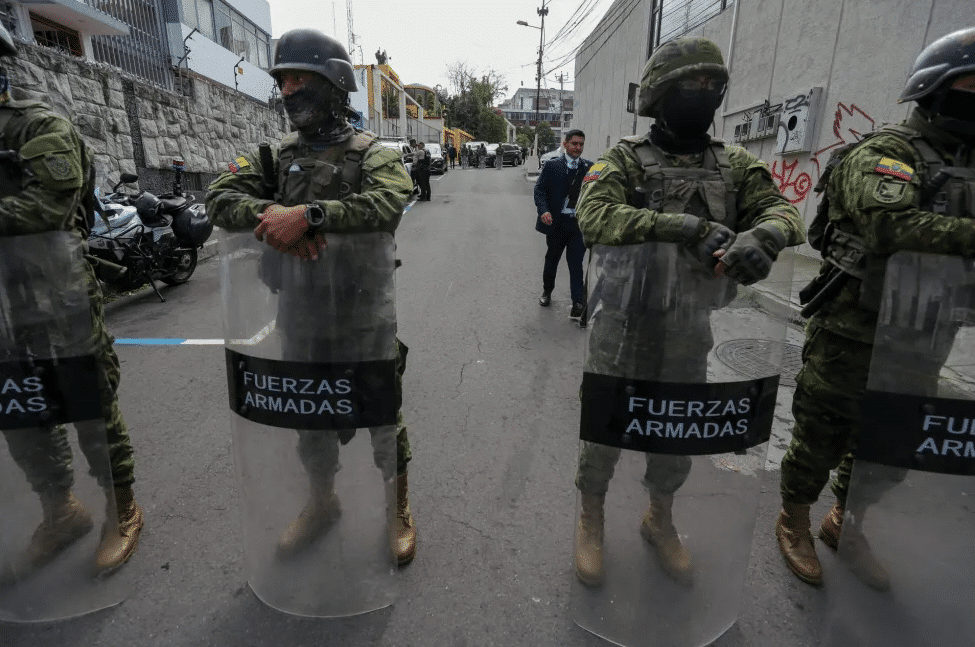

The Return of the Military

PUBLICIDAD 1M

PUBLICIDAD 4D

PUBLICIDAD 5D

The failed mega-projects: a Chinese satellite, a hydroelectric plant, an inter-oceanic canal, a port of Monkey Point, among others

A Chinese satellite

Venezuelan cooperation in Nicaragua is called to be the great milestone of the second decade of the XXI century, both for its magnitude, as well as for its scarce exploitation and then its fall. It was a period in which several of the main indicators grew (while the injection of Venezuelan petrodollars is sustained) and began to diminish as those resources decrease, to the point that several of them closed in 2020, returning to the level they had several years ago.

The decade was also marked by eight years of GDP growth, and by an invariable phenomenon of proposals of fantastic mega-projects that were deflated one by one, until they ended up -as a result of the socio-economic crisis that exploded in 2018, together with the sanitary emergency of 2020- in seven consecutive quarters (and ten of the last eleven) of decrease, already turned into an economic depression.

"From the economic point of view, Venezuelan aid was the most important variable of the decade, because of the magnitude of the resources received, and because of how ineffective it was," commented economist Juan Sebastián Chamorro.

It was "between 4 and 6 billion dollars. That will never be known, but it was an astronomical amount of cooperation, totally wasted: infrastructure was not built, nor were the investments that we would be using to generate growth developed", he assured.

His colleague, economist Néstor Avendaño, president of Consultores para el Desarrollo Empresarial (Copades), stated that the errors of criteria used to decide how those resources, which he puts at 5059 million, would be invested are not so great when including the amounts received since 2007.

"I believe that 60% of the 3860 million dollars received in oil cooperation between 2007 and 2018, which were destined to socio-productive projects, were well used", said Avendaño.

Several investigations by experts and journalists - among them, several publications by CONFIDENCIAL - show that almost 600 million USD of those resources were used to strengthen "energy sovereignty", a euphemism that most probably refers to the Albanisa plants; 50 million USD to acquire the Petronic gas station chain; and various amounts to take over the Seminole Hotel and a huge cattle ranch owned by the US tribe of the same name. The investment in real estate, the purchase of television channels, or the extraction and export of precious woods, among others, which passed to the control of the ruling family through Albanisa, are also reported.

Avendaño recalled that the area where he did express doubts was regarding the use of the remaining amount.

"The public criticism I made to this distribution is that the 40% destined to lift people out of extreme poverty, especially the rural population, especially the rural population, should have been directed to lift a large part of the peasantry out of poverty so that they could reproduce the inputs and capital goods they were getting donated, to produce, and transmit that productive culture to the extremely poor, but they were given to the extreme poor, who did not take advantage of it", he questioned.

An economist consulted by CONFIDENCIAL - who agreed to offer his view under the security of anonymity - said, considering the moment when the bulk of those resources were received, that, from the economic point of view, the decade could be divided into three large blocks.

The first one is the period from 2010 to 2016, in which "the growth rate accelerates, due to favorable tailwinds", such as the Venezuelan oil cooperation, since "the oil credit reaches to represent an average of 550 million annually, for 50% of the invoice with that country, plus about 450 million annually for the other part of the invoice that is not paid either, but is destined to buy products from large exporters, to send them to Venezuela".

He added to this "the boom in the price of commodities, and the boom in foreign direct investment (FDI)".

The next two periods are the biennium 2016 - 2017 when an economic slowdown is observed, "to the extent that those tailwinds weaken or disappear", and then, the period 2018 - to the present, which begins with "the crisis triggered by the lethal repression and the uncertainty generated by the set of public institutions turned into repressive apparatuses and generators of chaos".

Contrasting with this data, another economist, who also requested anonymity, said that the first period can actually be divided into two, with a first part in which "the exit from the financial crisis (global of 2008 and 2009) and stabilization" occurs, and then, a second part in which "a strong growth is observed, which concludes in 2016".

He recalled that there was a boom in exports during this period, which is explained by the high amounts of Venezuelan cooperation, the growth of FDI and remittances, plus the boom in the prices of raw materials, which allowed taking advantage of the Free Trade Agreement with the United States, Central America, and the Dominican Republic, in addition to boosting exports made by companies attached to the free trade zone regime.

Most of the available statistical data follows the same up and down the curve. This happens, for example, with the GDP per capita, which starts the decade at $1506.1 dollars per inhabitant, and grows eight consecutive years, but will close 2020 at $1823, "similar to 2013", if Avendaño's forecasts, who expects the GDP to fall 6.1% in 2020, are fulfilled.

Similarly, merchandise exports grew around 400 million per year in 2010, 2011, and 2012, fell in 2013, and recovered in 2014, to decline in 2015 and 2016. In this case, the substitution of destination markets, allowed the private sector to resume export growth for three consecutive years, which resulted in almost 2700 million in 2019, according to data from the Central Bank of Nicaragua (BCN).

The estimate for 2020, is that they could close at "almost 2800 million dollars", according to Avendaño, or at "almost 2900 million", according to Guillermo Jacoby, president of the Association of Producers and Exporters of Nicaragua (APEN).

In the end, whether Venezuelan cooperation in Nicaragua totaled more than $4 billion, more than $5 billion, or more than $6 billion, the economists consulted are left with the feeling that more could have been done.

"If it had been invested in roads, in infrastructure, in services, that would continue to generate dividends to this day, but the proof that it was money badly invested, is that the moment this cooperation began to fail, the growth rate began to suffer by one, two, three points, and then came the socio-political crisis," said Chamorro.

"What happened was a partial use, because much of that money only ended up expanding consumption and commercial opportunities, but the country was left skating on the same products as always, while a developing economy should have looked for items with higher added value," said one of the economists mentioned above.

That money "was not used optimally but was used as a political tool, when it could have been more beneficial, to develop the country's industrial capacity", as neighboring countries did, even without that injection of resources, he pointed out.

The headquarters of the Social Security National Institute, in Managua. Carlos Herrera/Confidencial

In 2012, the Nicaraguan Social Security Institute (INSS) accumulated some 16 billion córdobas in reserves, which had increased by almost 3 billion córdobas during the first two years of that decade.

2012 was the last year in which the Institute accumulated reserves. Starting in 2013, its balances showed deficit after deficit, until, sometime in 2019, the count returned to zero.

"That's what happens when you don't make the number of active contributory insured grow," says actuary Róger Murillo, who specializes in social security issues. "In order for that (number) to increase considerably, the government has to create favorable conditions for investment," he said.

Instead, those who had the capacity to do something, spent several years at the beginning of the decade postponing the start of negotiations, with the perfect excuse that "we are in a pre-electoral year", or "post-electoral", or "municipal elections", which made it inadvisable to start any serious negotiation, at the risk of contaminating the negotiations.

The reform was criticized by the decision -in July 2013- to grant, at the expense of INSS funds, thousands of reduced pensions to retirees who had not complied with the minimum requirement of 750 weeks of contributions, which hit the Institute's reserves, and five years later, led to a series of unilateral measures, which quickly derived in the so-called April Rebellion.

Although Resolution 1-317 was only four days old, in February 2019, the official steamroller was imposed, and a new package of unilateral measures was approved, which turned out to be harsher than those of the previous year.

Nicaraguan President Daniel Ortega and Wang Jing hold the signed documents of the framework agreement for the construction of the Interoceanic Grand Canal. Managua Nicaragua on June 14, 2013. AFP/INTI OCON

In 2012, it was announced that the construction of a satellite was being commissioned to the Chinese company Great Wall Industry Corporation, at a cost of 300 million dollars, a price that would escalate to 346 million. The satellite baptized Nicasat - 1, was never built.

The Grand Canal construction project at an initial cost of US$40 billion (escalating to US$50 billion), signed in June 2013, was meant to be the culmination of a dream of five centuries, as well as the definitive boost needed by the Nicaraguan economy to grow and generate jobs.

Instead, it became the fuse that lit the indignation of the peasant sector, which staged nearly a hundred protest marches. Seven years later, the project went no further than a road inaugurated with great pomp in Rivas, and piles of studies and declarations that led nowhere.

In July 2015, Ortega asked his Taiwanese counterpart, Ma Ying-Jeou, for support to build a deepwater port at Monkey Point, in the Nicaraguan southern Caribbean, budgeted at some $500 million, which had been proposed earlier to Venezuelan President Hugo Chavez, as well as to the Brazilian company Andrade Guterres.

After five years of plans and modest progress, the project to build the Tumarín hydroelectric dam, called to generate 250 megawatts at a construction cost of US$1.1 billion, was canceled in April 2016, after the withdrawal of the company in charge of its construction was announced, followed by the news that Brazil had decided to cut funding to the project.

A month after the hydroelectric dam was canceled, Ortega revived another long-dormant project: the transfer of the waters of the Cocibolca to the Xolotlán, to irrigate the plains bordering it, and increase the country's agricultural production. Almost five years later, the project is still in its decades-long lethargy.

In January 2020, it was time to promise a plant capable of generating 300 MW of electricity with gas. The cost of 700 million dollars, announced by government spokespersons, surprised representatives of New Fortress Energy (NFE), the company that received a concession, as well as a package of tax exemptions, to start building the facilities to unload and store the gas in Puerto Sandino, in the Nicaraguan Pacific.

In December 2012, after more than two years of voluntarily abstaining from discussing a tax reform that should not be politicized, the National Assembly approved the Tax Concertation Law, which enjoyed the broad consensus of the Superior Council of Private Enterprise (Cosep) -then the Government's privileged interlocutor- as well as other entities of lesser precedence.

It was, to a great extent, a pyrrhic reform, which only contemplated an increase in tax revenues of less than one percentage point, or to maintain the exemptions for two more years for companies that met certain requirements, and gave way to new discussions in the following years, to implement additional reforms, such as the idea of taxing luxury yachts and helicopters.

Faced with the collapse of economic activity as of April 2018, when violent government repression led to political prisoners, several hundred deaths, tens of thousands exiled and hundreds of thousands unemployed, the Government issued a new tax reform in March 2019, with which it intended to raise US$300 million, despite the fact that by then, the country had almost half a year of being in recession.

Although some tax collection goals were partially met, this was possible at the cost of severely hitting the economy of companies and their ability to generate profits or their decision to reinvest, which is manifested in an annual budget that barely grows nominally.

This article has been translated by Ana María Sampson, a Communication Science student at the University of Amsterdam and member of our staff*

PUBLICIDAD 3M

Periodista nicaragüense, exiliado en Costa Rica. Durante más de veinte años se ha desempeñado en CONFIDENCIAL como periodista de Economía. Antes trabajó en el semanario La Crónica, el diario La Prensa y El Nuevo Diario. Además, ha publicado en el Diario de Hoy, de El Salvador. Ha ganado en dos ocasiones el Premio a la Excelencia en Periodismo Pedro Joaquín Chamorro Cardenal, en Nicaragua.

PUBLICIDAD 3D