4 de marzo 2017

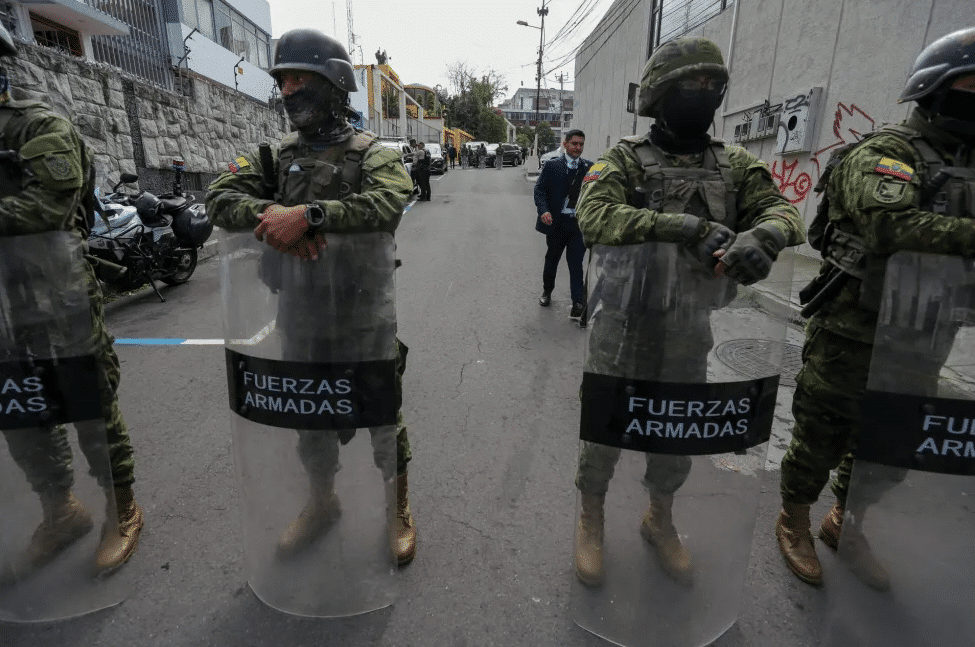

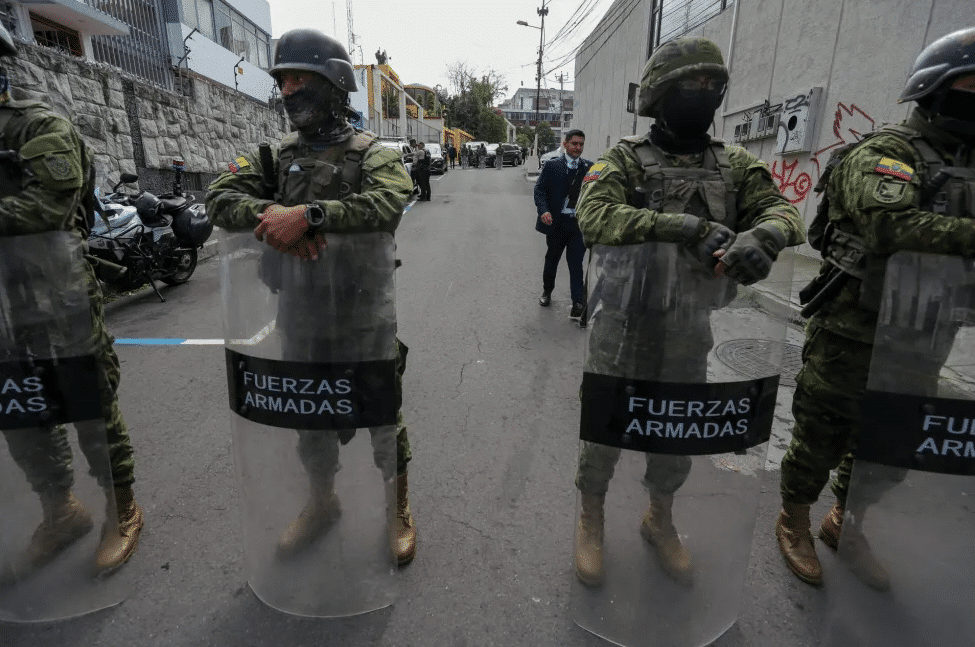

The Return of the Military

PUBLICIDAD 1M

PUBLICIDAD 4D

PUBLICIDAD 5D

Carlos Amador: “Office buildings are filled as they become available,” but it’s more difficult to market apartment buildings.

Carlos Amador: “Office buildings are filled as they become available

The real estate business maintains stable growth in Nicaragua, with each sector selling at a different rate, depending on the characteristics of the market.

At the moment, office buildings and commercial centers seem assured of finding tenants, housing developments for the middle and working class families sell at a reasonable rate, but luxury condos fill more slowly.

The losers in this competition are the apartment buildings; these are difficult to sell for several reasons, beginning with cultural acceptance.

“A person who’s going to invest some US $150,000 - $200,000, which is the going price for one of those apartments, prefers to use that money to buy a house where they can have a yard, a porch, etc., because in Nicaragua there’s still a lot of land. In addition, there’s a fear of earthquakes,” explains Carlos Amador Torres, president of Discover Real Estate.

In the case of apartment buildings in Managua, an additional factor is the reputed risk.

According to Amador, “Today’s buyer, in contrast to those of seven or eight years ago, is a more informed buyer and asks a lot of questions: What group is behind this? Who’s the contractor? How was it built? These factors are important for people who want to be able to better evaluate the risk, right up to knowing the origin of the funds it was constructed with.”

Today, “People are more cautious and want to know where the funds came from. Before, they would invest even without seeing the property. Now they ask intelligent questions and even want to see the blueprints. They’re concerned about the legal issues and make sure their lawyers have gone over everything from A to Z,” states Amador.

Greater demand for office space

The corporate office spaces have been successful because there was almost nothing similar.

“Many companies have their offices in older upscale residential areas, such as Bolonia, Las Colinas, Santo Domingo, etc. Because of that, new office buildings sell easily. By moving to one, companies improve their image, have better conditions and enjoy greater exposure to more clients.”

A common argument in the sector is that a company can be paying US $500 monthly to rent a house, and also have to foot the bill for security personnel, pay a high electricity bill due to inefficient air conditioning, and cover the maintenance of the house.

Amador assures: “As people have figured this out, they’ve been leaving those old residences. Now there are a lot of vacant houses - to the point that they’ve had to lower their rental price, which has fallen from US $1500 a month to as low as $500 in some cases.”

“The tendency is for these large number of offices sited in the neighborhoods and old residential developments to move to an office building.” Although Amador notes that “the office building that comes on the market fills up,” he also warns of the risk of reaching a saturation point for such buildings.

Know where to buy

Amador explains: “The price of land is higher within the urban boundary of each city. In Managua, it’s more expensive to buy in the center and in the most exclusive areas, such as the Jean Paul Genie neighborhood, or the commercial belt where the new buildings are being constructed.”

He’s referring to the circle that begins at the Metrocentro roundabout, then runs along the Masaya highway to the roundabout at Centroamérica and from there to the University roundabout, turning towards the Nicaraguan National University (UNAN) and the Jean Paul Genie Avenue, until once again it meets the Masaya highway. It then runs up the Masaya highway until kilometer 12, “where the price of land begins to drop.”

That general pricing scheme functions in a similar way whether you want to buy land in Managua, where the prices are highest, or outside the capital. After Managua, San Juan del Sur, Granada, Leon, Estelí and Matagalpa as the most expensive parts of the country, in that order.

Amador referrs to the fact that the commercial zones of Estelí and Matagalpa (and to an extent also those of San Juan del Sur) are very expensive because they’re among the most saturated areas outside the capital. In those zones, there’s little land available and this sometimes leads land prices to reach levels similar to those in Managua.

“All over the country, the commercial areas are the ones that have the highest prices, to the point that if you go back one block from the most trafficked areas, the price goes down considerably,” he explains.

Offering himself as an example, he notes that buying land along Jean Paul Genie Avenue can cost US $160 per square yard, “although there are those who ask up to $250, but that’s regulated by the market. We went back just over 100 meters when looking for a site for the Escala building, and managed to buy for US$60 a square yard,” he relates.

The later repercussions was that the building’s construction triggered a revalorization of the price of that land. “It normally rises some 20-30%, due to the improvement considered a result of the materialization of a project,” adds Amador.

Real estate price bubble

Amador recalls that over five years ago there was a price bubble that led to some properties being sold for as much as $500 a yard. “Today, nothing gets sold at that price, or even at $300. It’s not easy to find someone who wants to pay such a price. The most expensive land at this time isn’t worth over $250 dollars a sq. yard, whereas at some moments within the bubble, there were lots sold at $350-$400 a yard.”

In 2006, Daniel Ortega arrived at the presidency and when the national and international investors saw that nothing happened and things remained the same in his second period, “The fears ended.”

“During that second term, Nicaraguans lost their fear of investing; Central Americans began to arrive in greater numbers to invest in Nicaragua, because in some cases their countries of origin are very violent. That caused Nicaraguans to wake up and begin to invest in their own country,” Amador relates.

He continues: “One of the iconic projects that led more people to decide to invest in Nicaragua was the Escala building that was constructed almost simultaneously with Invercasa’s Tower 3. There were very positive steps for the Nicaraguans’ perception.”

Although Ortega’s second term didn’t affect the real estate business, there was a period of 30 – 60 days at the end of last year in which there was in fact a “passing effect” caused by Trump’s ascension to the presidency and the United States Congress’ approval of the Nica Act.

Looking back on that period, Amador assures that the “turbulence” has passed over. The market has now recovered confidence and the businesses are proceeding normally.”

Cheapest land in Central America

“In Nicaragua you can buy a property along a central avenue like the Jean Paul Genie or the Masaya highway for $150 a square yard. In Tegucigalpa, for example, it costs $1,000 a yard. A property in a first class housing development, that costs $40 a square yard here will cost you $250 there for the same measure,” assures Carlos Amador of Discover Real Estate.

He explains that it’s the same in Costa Rica or El Salvador, although in the latter country the problems with security depress the prices; at the same time, as such a small country, land is ever scarcer.

“In general, prices in the region are far above our prices. It’s all on another level,” he explains. The insecurity as well as the saturation with which the real estate brokers must cope in those countries (which has a depressing effect on the businesses’ profitability) causes companies to look to Nicaragua which they still consider “a land of opportunities.”

The reason is that in Nicaragua you can obtain profit margins of 17%, while in their own countries they must operate with profit margins of 4 – 7%. “The competition is fierce for them. They have to lower their prices and be more competitive.”

In our case, “What’s missing is the market. We lack demand to buy all these real estate products, for example offices, commercial spaces, etc., to the point where there’s a risk of the businesses reaching a point of stagnation because there’s not enough demand, nor is there the same buying power that there is in other countries.”

“We have to be careful with that; there’s a very fine line between the country’s capacity to produce and be self-sufficient,” the businessman warns.

Archivado como:

PUBLICIDAD 3M

Periodista nicaragüense, exiliado en Costa Rica. Durante más de veinte años se ha desempeñado en CONFIDENCIAL como periodista de Economía. Antes trabajó en el semanario La Crónica, el diario La Prensa y El Nuevo Diario. Además, ha publicado en el Diario de Hoy, de El Salvador. Ha ganado en dos ocasiones el Premio a la Excelencia en Periodismo Pedro Joaquín Chamorro Cardenal, en Nicaragua.

PUBLICIDAD 3D